100X.VC: Building A Bridge Between Traditional Companies And New-age Startups

Yagnesh Sanghrajka, cofounder, 100X.VC

Yagnesh Sanghrajka, cofounder, 100X.VC

Image by Mexy Xavier

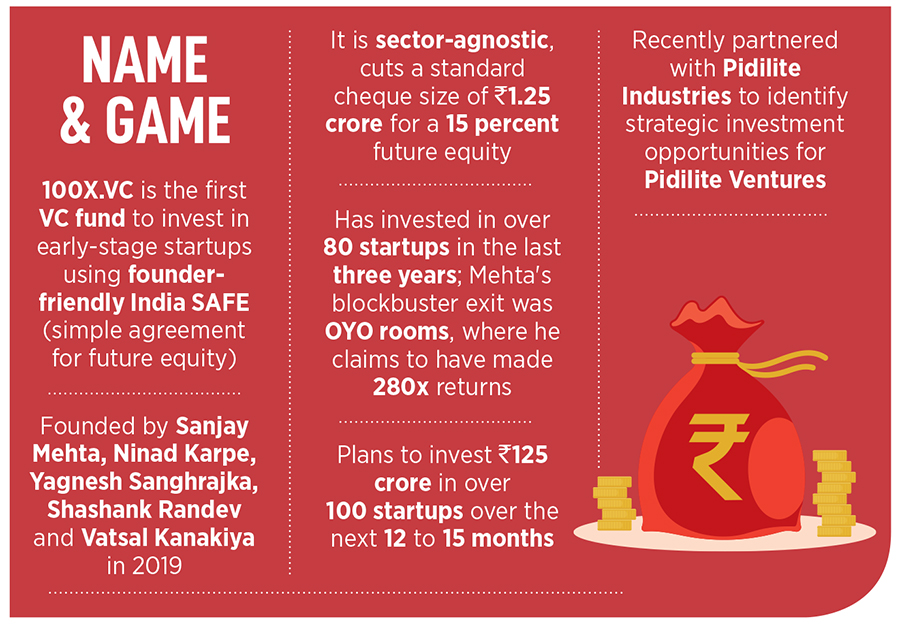

WYagnesh Singhrajka seeks stickiness when it comes investment. “It has to have a unique value proposition,” reckons the co-founder and chief financial officer of 100X.VC, an early-stage investment fund. Venture capitalist Sanjay Mehta, Ninad Karape, Shashank Randev and Sanghrajka co-founded 100X.VC in 2019. “Everybody must find the product sticky,” he says, dishing out the example of BuildNext.

Gopikrishnan and Finaz Naha founded the Kochi-based tech-enabled builder in 2015. They offer a range of solutions including visualisation, estimations, product selection, budget control, project tracking, and procurement. Sanghrajka explains that BuildNext provides transparency and reduces overshoots and costs in building construction. But for a fund which cuts a standard cheque of ₹1.25 crore for a 15 percent future equity in startups and also happens to be a first institutional investor, what was so sticky and compelling about BuildNext, which already had backers? “It’s Pidilite,” he smiles.

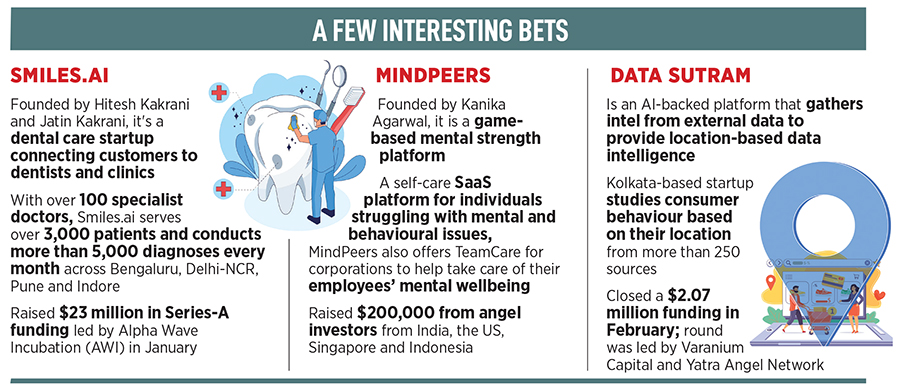

It was a short brief to 100X.VC. Pidilite (the makers of Fevicol brand adhesive) was eager to inject corporate venture funds into startups with an innovative business model. BuildNext’s offering and segment in which it operated interestingly had a strong overlap with Pidilite. “We knew Pidilite’s products would make sense for these kinds of businesses,” says Sanghrajka, who did the initial round of screening, evaluation, preliminary talks with the startup founders to gauge their interest and then connected the interested parties. Pidilite made a $3.5million Pre-Series A Investment in July of this year.

100X.VC had more in store for Pidilite’s corporate venture capital. Kaarwan was another opportunity for investors. It is an educational and upskilling platform designed for architects and designers. Finemake, an online platform that allows users to design, customize, and book modular kitchens, wardrobes, and TV units, was another venture that caught the attention of the fund. Sanghrajka says that the venture fund and corporate giant Finemake are a rare collaboration in a country where traditional brick-and-mortar players are increasing their exposure to startups and innovative products. Pidilite, in fact, has made a lot of such investments. This includes funding in HomeLane or Livspace.

The early-stage VC funds are increasing their play by including corporate levers in their strategy. It’s simple. India Inc is frantically searching for disruptive startups that could help traditional companies access new opportunities. For large companies that are able to quickly add value through acquisitions of nimble startups, pressing the acquire button makes perfect sense. “We are a unique bridge between a corporate and a startup fund,” says Sanghrajka, adding that 100X.VC is well placed to handhold corporates.

An experienced venture capitalist, he points out the dual benefits of his fund. 100X.VC is an early-stage investment firm that has more access to the market. This means that 100X.VC has a wider and deeper reach to the talent pool. This also allows you to get an early entrance into the journey of a startup still at the beginning stages of its valuation climb. “We are not advisors. We don’t make money on a transaction fee,” he says, alluding to partnerships with the corporates. “Our only revenue model is exit,” underlines Sanghrajka. He admits that he takes a substantial minority of a corporation and builds it up slowly. A roll-up is possible at some point. Second, 100X.VC is not only a matchmaker but also manages portfolios, monitors and provides management services even after a corporation has made an investment. “It’s a non-stop engagement, and we know the long-term value,” he adds.

Meanwhile, in the short term—over the last few years to be precise—early-stage investment ecosystem has exploded in India. It rose from $5.1 billion in 2019, to $8.7 million in 2021. The numbers declined in 2020 due to Covid, but rebounded strongly the next year. They posted $7 billion in the first three quarters this year. Sanghrajka doesn’t see any reason for the inflow of funds to slow over the next few decades. “Funding winter has not impacted early-stage investment,” he says.

Also read: Early to bet & early to rise: How Antler is changing early-stage investing in India

It’s not hard to fathom why the early-stage ecosystem has survived the winter chill. A startup in pre-seed or seed is currently at the 0-1 stage of its journey. It’s a phase when the founder will keep experimenting, exploring, pivoting to find product-market fit, growth and revenue. This stage is where money acts more as oxygen than rocket fuel. There is no rush among VCs for funding startups. Funding is available even at the late stages. “Money is always available for smarter guys,” contends Sanghrajka. He adds that most of the great companies were created in recession. Fundraising is easy if the founder has been disciplined with capital usage, not allowed unit metrics to go stale, and has maintained the value it has achieved. “There is no fear of missing out (FOMO),” he says.

FOMO is most prominent in the very early stages. This keeps valuation rational, sober, and rational. Funding winter, Sanghrajka explains, is for the growth-stage startups who picked up funding at fancy and sky-rocketing valuation last year, and now can’t get money at the same insane multiples. “Forget chill. It’s warm and the sun is shining brightly for early-stage startups,” he says.

However, too much sun can also be a problem. The early-stage funding environment has become a mess over the past few years. Angels have also been giving trouble to institutional VCs. “The angels definitely have become bolder and are cutting big cheques,” acknowledges Sanghrajka, adding that founders have an easy access to capital and don’t have to depend on VCs as their only source of money. But he quickly clarifies that he does not compete with angels. “We are competing with bigger boys who are cutting smaller cheques,” he adds.

What is the flip side of this coin? With angels, early-stage VCs and a bunch of big boys—late-stage funders also getting into early-stage investing—chasing rookie founders or at times serial founders, what does this mean for funds like 100X.VC? Sanghrajka highlights the biggest problem. “A lot of early-stage guys will face credibility issues,” he underlines, explaining his point.

There are two types of businesses: VC-funded businesses and lifestyle businesses. The latter might look attractive in terms of unit economics but doesn’t have scale. “So these are not the ventures where VCs would put money,” he says. The problem arises when an investor can’t differentiate between these two kinds of businesses and gets too enamoured with the lifestyle ones. This can lead to exit problems. The second problem is from founders’ side. With ‘all angels descending to earth’—as one of the VCs took a dig at the alarming pace at which everybody is turning angel and cutting cheques—founders will realise that devil lies in detail.

Handing too many angels won’t be an easy task. “Moreover, early-stage is no more about capital,” says Sanghrajka. “That’s why funds like 100X.VC come into picture,” he adds, underlining that irrespective of the dynamics of funding, the nature of doing business will never change. He offers one piece of advice to budding entrepreneurs: Learn numbers. “I have seen a hell lot of brilliant product and tech guys,” he says, alluding to his interaction with thousands of founders during VC pitches.

Although most of them are promising, they do not have the ability to understand financials, cash flow, and burn. “Homemakers knows their math,” he signs off.

Enjoy our festive offers of up to Rs.1000/off on Subscriptions and a Gift Card worth Rs 500/- at Eatbetterco.com. Learn more by clicking here

This story appeared in Forbes India’s 18 November 2022 issue. You can visit our Archives by clicking here.