It’s been a bumpy 6 months for edtech — are smoother roads ahead?

This has been a misunderstanding The global startup ecosystem has had a rough six months. The saga of the ‘Secret’ has begun The advancement of generative AI is exciting as well as alarming, with its increasing understanding of the applications.

It’s our view that we are coming to the end of the hype cycle, and startups, even those that previously didn’t have any generative AI plans, are beginning to look at immediate uses rather than just the moonshots and associated disruption it can cause, including in schools and workplaces.

By focusing on immediate needs, we can minimize disruptions once longer-term plans begin to be implemented. This theme has been well explored by others, so let’s turn to other developments in H1 2023.

The fall of Silicon Valley Bank caused significant discomfort, but the long-term impact on the ecosystem was minimal, especially in Europe. This is due to the actions of governments and partners. In the U.K., this respite was provided by HSBC, which stepped in to ensure stability for thousands of startups across the country, but minimal disruption was felt in the European Union, given the bank’s limited presence in the markets.

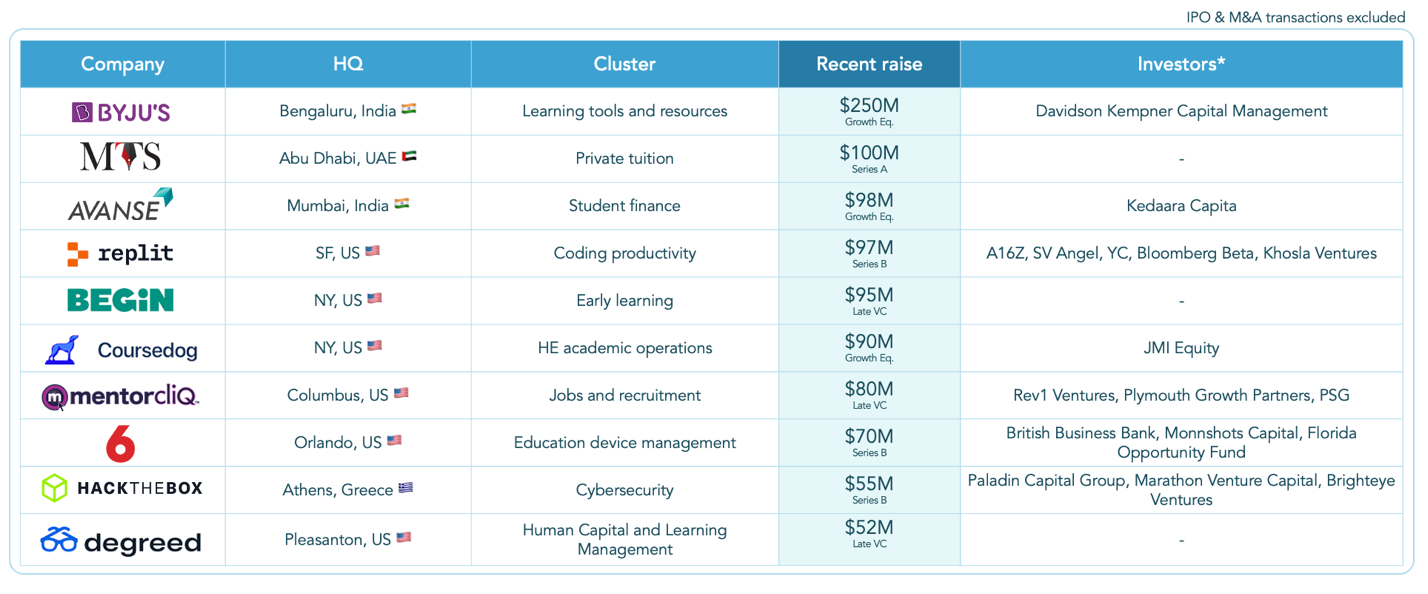

Edtech companies who raised rounds in H1 2023. Image Credits Brighteye

Turning now to global edtech, the market has continued to stutter, exemplified by Chegg’s fluctuating valuation, kicked off not by unexpectedly negative results but by merely acknowledging the risks of generative AI to the business.

Let’s take a closer look at what happened in the European edtech ecosystem. These are our key learnings.

My Tutor Source became the first MENA-based edtech startup to raise $100 million, which bodes well for the region’s ecosystem, previously more dependent on U.S. and U.K.-based startups for edtech activity than homegrown companies. The remaining large deals of $80 million – $100 million tended to be companies raising later stage funding, like Degreed and Begin. One European deal made the top 10: Hack the Box’s $55 million Series B (a Brighteye portfolio company).

Using this segue into Europe, the announced $1.7 billion privatization of Norway/U.K.-based Kahoot by a Goldman Sachs–led group presents a bright start to H2 2023, with the compelling cash offer representing a greater than 10x multiple on revenue. The deal spotlights a trend we anticipated in our annual report in January — growing M&A activity as companies begin to favor exits over raising down rounds and risking becoming zombies.

In general, we do not expect an increase in European activities in H2 of 2023. H2 2022 was a period of increased funding. In H1 2023, the funding levels were higher than in the previous period.

This should not be seen as signs of health in the ecosystem, however — what will be more telling will be:

- These companies raise money to take advantage of opportunities (or stay afloat).

- This will tell you whether these companies raised more funding or less than they did in their previous round.

Let’s take a closer look at what happened in the European ecosystem. Here are five key lessons:

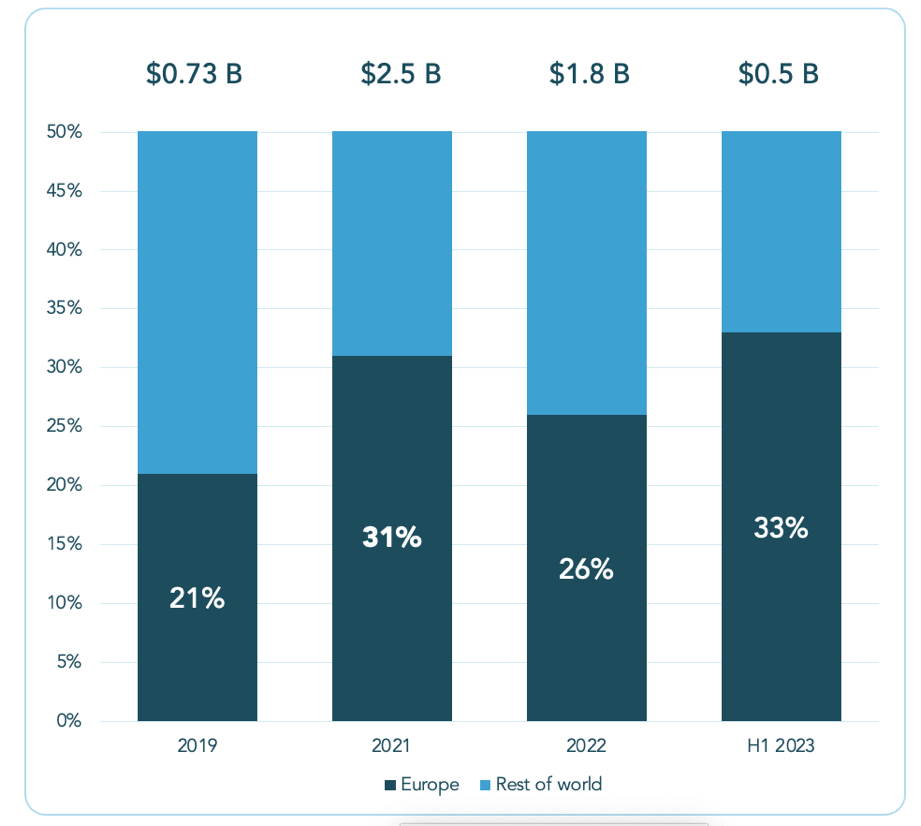

Europe is home to one-third of all global edtech transactions

It’s positive to see the European edtech market holding firmer than other major markets in North America and Asia in terms of deals activity, but activity by funding and deal count is down across the board.

The European edtech pie is bigger than the American one:

The European edtech pie is bigger. Image Credits Brighteye

H1 2023 has seen more funding and a larger average deal size.

Although the pie is smaller, the European ecosystem had a stronger H1 2023 compared to its H2 2020, with higher funding and a larger average deal. In H2 20,22, the European sector of edtech secured $0.4 billion. However, this increased to $0.5 billion in H1 2020, despite very few large transactions.