Technology Outlook: Wide Format and Signage

Final week, as a part of WhatTheyThink’s fourth annual Know-how Outlook Week, our five-day collection of webinars that have a look at the most recent developments and applied sciences in a broad cross-section of the trade, Richard Romano and Cary Sherburne tag-teamed a have a look at wide-format and signage and textiles and attire. This text recaps the wide-format portion of the webinar

Final week was WhatTheyThink’s fourth annual Know-how Outlook Week (jeepers, has it been 4 years already?), our five-day collection of webinars that have a look at the most recent developments and applied sciences in a broad cross-section of the trade—digital printing, software program and workflow, labels and packaging, and ending.

On Thursday, in a session sponsored by EFI, Cary Sherburne and I tag-teamed a have a look at wide-format and signage (me) and textiles and attire (Cary)—with a good quantity of overlap. On this article, I’ll recap the wide-format portion of the webinar and the textiles and attire portion in a separate article. (You’ll be able to watch your entire webinar right here.)

What Form of Day Has it Been?

In case you will have been trapped in an underwater pyramid for the previous 4 years, right here’s the story up to now:

By the tip of the 2010s, the migration to wide-format on the a part of common industrial printers had been largely slowing. However then—wham!—2020 occurred, and wide-format printing was a saving grace through the pandemic, what with the notorious “pivot” to security signage, distancing dots, and all of the show graphics ephemera of the lockdown months. Extra importantly, there was additionally the shutdown of key vertical markets for show graphics producers, corresponding to occasions, journey, and many others.

Then, in 2021, issues began to return to regular as we spent the yr rebuilding the trade (and the economic system). There have been occasional virus variant-related snags, and macroeconomic indicators had been far and wide, however general issues had been getting higher. In 2022, it was a case of “Virus? What virus?” and the notorious “provide chain challenges” dominated the headlines. For industrial printers, getting paper was the massive problem, and for show graphics, sure sorts of vinyl, aluminum and different supplies for signmaking, and different consumables had been a little bit of a problem to get—and when you could possibly, they had been costly.

Now, the place are we in 2023? We’re beginning to see outlets specializing in show graphics begin to take a look at diversification into new areas. In any case, after the massive migration into vast format within the 2010s, there’s extra competitors than ever. So the place are they wanting? Some are taking a look at label printing, some at packaging, and no small quantity are taking a look at diversifying into textiles.

Smithers has a reasonably bearish forecast of the show graphics and signage market. Of their current report The Way forward for Printed Signage in a Digital World to 2028, they see the worldwide worth for “posters, banners, flags, backdrops, point-of-sale (PoS) shows, billboards, decals & transfers, car/fleet graphics, constructing wraps, company graphics, and commerce present supplies” in 2023 will attain $40.99 billion—down ~$5 billion from their pre-pandemic worth. They add:

- Quantity of printed signage has fallen from 10.81 billion meters sq. in 2019, to eight.92 billion meters sq. in 2020, though demand for printed signage did recuperate in 2021–2022.

- Output for all printed signage is projected to succeed in 10.08 billion meters sq. in 2023

- Upward trajectory is now levelling off due to inflation, vitality prices, and geopolitical points.

- Demand for printed signage will solely develop marginally—worth growing at 0.2% CAGR to $25.15 billion in 2028.

- Volumes have a 0.7% CAGR to 2028; international output will attain 10.43 billion meters sq. in 2028.

Smithers is a little more pessimistic than I’d be, however their upshot is that there’s an elevated have to diversify into new utility areas. (By the way in which, it’s value mentioning that analysts additionally see the growth of dynamic digital signage may even erode demand for printed and fabricated show graphics and signage, however I’m not fully satisfied that the switchover goes to be as substantial as others declare.)

The Graying of Broad Format

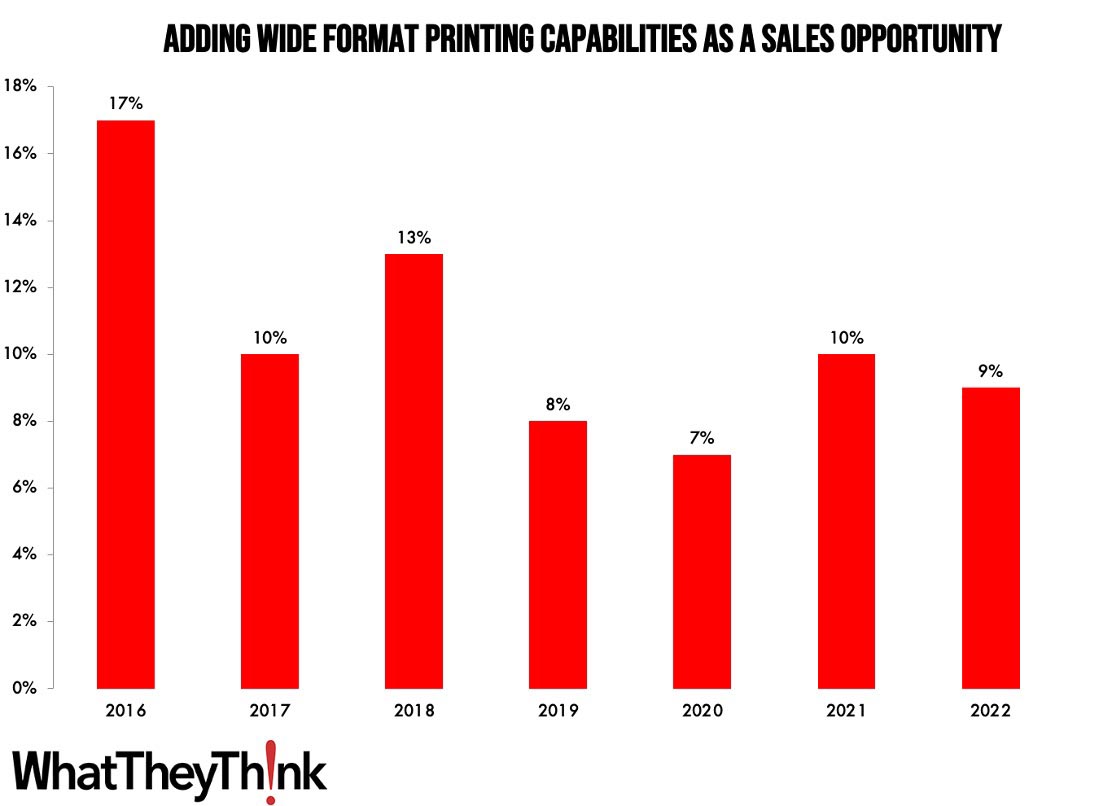

And it’s true that our annual Print Enterprise Outlook surveys have discovered a cooling of curiosity in wide-format printing as a new enterprise alternative:

WhatTheyThink Enterprise Outlook Surveys, 2016–2022

(Cary identified through the webinar that the print franchises—Sir Speedy, and many others.—are nonetheless including wide-format gear and searching for new alternatives in show graphics.)

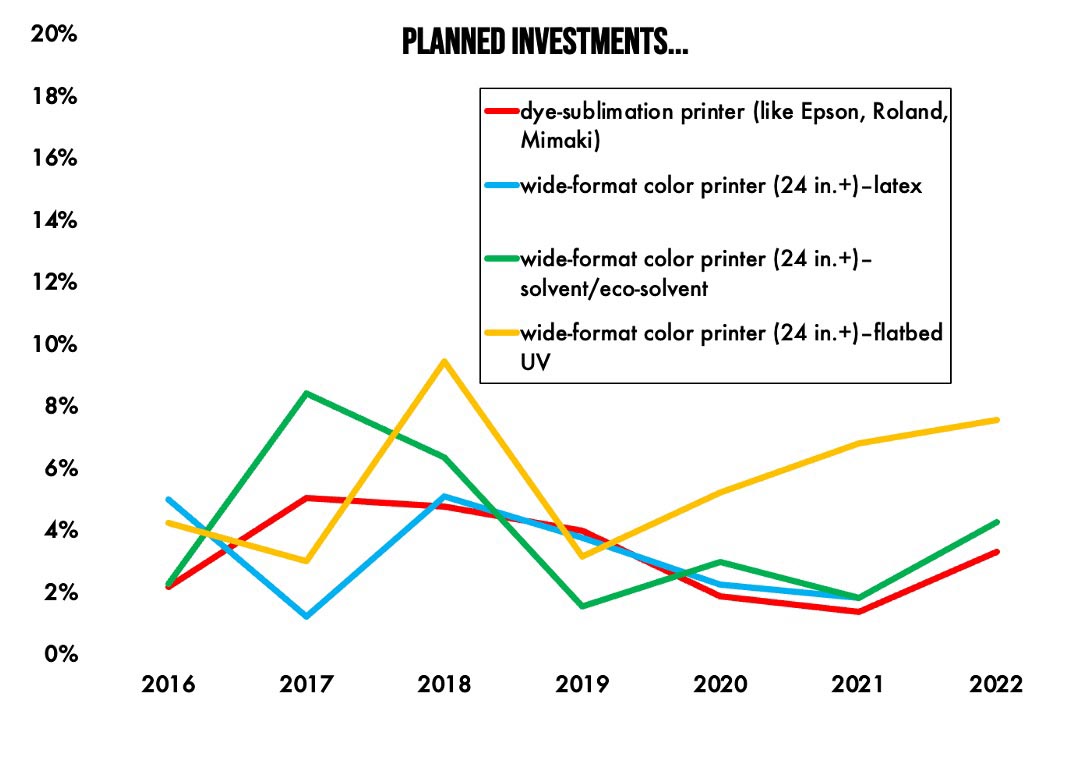

Funding in wide-format gear continues apace, with especial curiosity in flatbed gear:

WhatTheyThink Enterprise Outlook Surveys, 2016–2022

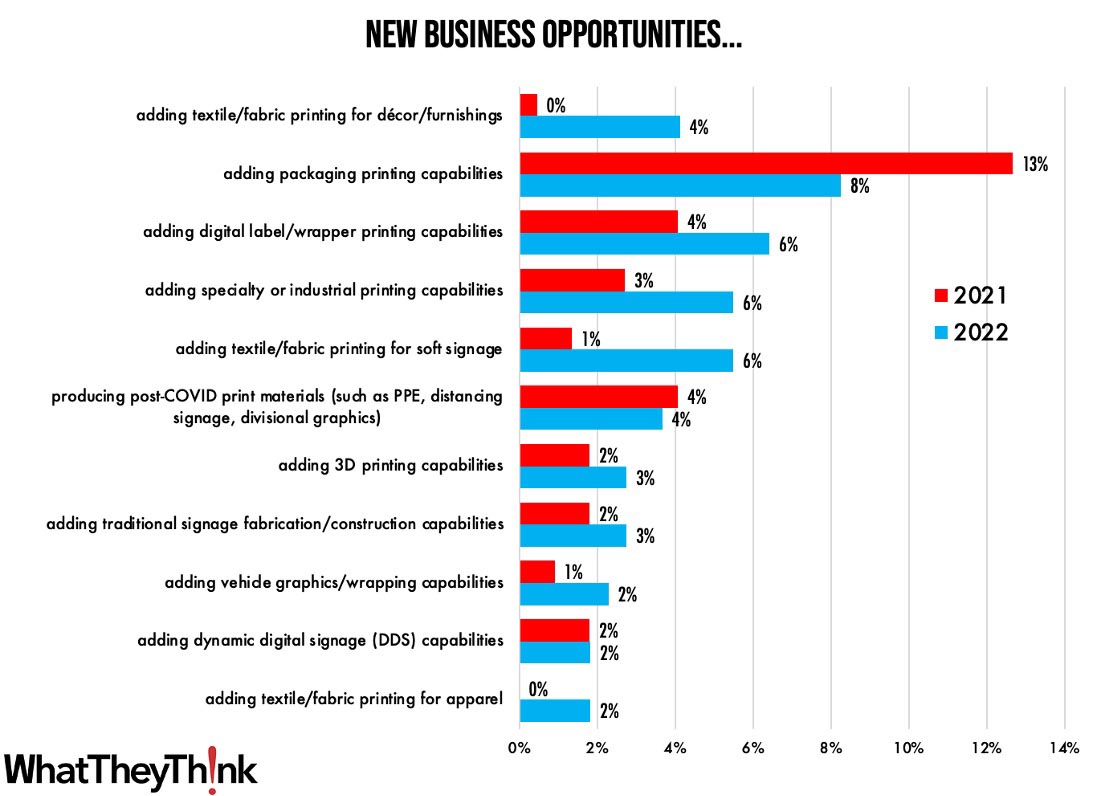

In our 2021 survey, we added some new gadgets to our “new enterprise alternatives” query, and we do see that there’s some elevated curiosity in print companies entering into textile printing for décor (wallpaper is a big new space), label printing, specialty or industrial printing (consider advert specialties and promotional gadgets, water bottles, and many others.), and delicate signage.

WhatTheyThink Enterprise Outlook Surveys, 2021–2022

Two knowledge factors don’t a development make, so we might be monitoring these additional in future surveys. Nonetheless, it does counsel that print companies are wanting past show graphics—and that many wide-format printing units also can produce these purposes makes it that a lot simpler to get into.

Automation

The dialog round “automation” can imply various things relying upon which a part of the printing trade you might be speaking about. On the whole industrial printing—as Pat McGrew and Ryan McAbee mentioned of their Know-how Outlook session—“automation” tends to seek advice from the up-front processes: estimating, pricing, and many others., and linking these processes to manufacturing for functions of stock administration, scheduling, and many others. In wide-format printing, the automation dialog facilities round manufacturing processes: “RIP and print”; imposition, nesting optimization, and job preparation; the flexibility to routinely apply premade settings to jobs; and the flexibility for one workflow to deal with various kinds of purposes (show graphics, textiles, and many others.). And naturally wide-format automation additionally more and more contains robotics, corresponding to robotic arms for board loading/offloading.

Outlook

As we cost by way of 2023, here’s what the dominant developments are going to be:

- “Provide chain” issues easing—if not eased utterly—though there may be nonetheless average worth inflation.

- Automation— software program and {hardware}—will proceed to evolve and be adopted. Right here come the robots!

- Two sides of the employment problem: manufacturing employees shortages, will proceed however extra entrepreneurial enterprise house owners, particularly in franchises.

- Certainly, since COVID, there have been extra entrepreneurial employees general. New enterprise formation spiked in 2020 (The Nice Resignation) and whereas down from its peak, continues to be at historic highs. Many of those new companies are in conventional wide-format and signage verticals like retail. New companies characterize good alternatives for brand new clients as they typically want a variety of the issues that printers and signal outlets produce.

- Experiential graphics headed for a rebound as workplaces proceed to reopen. Many companies/organizations could really feel it’s a superb time for a rebrand/refresh. On the identical time, downsized workplaces/new areas additionally present alternatives.

- Business development has been gradual however seems like it could be selecting up. Stated the American Institute of Architects (AIA) Chief Economist, Kermit Baker PhD: “The continuing weak spot in design exercise at structure companies displays shoppers’ issues concerning the financial outlook. Excessive development prices, prolonged undertaking schedules, elevated rates of interest, and rising issue in acquiring financing are all weighing on the development market.” This impacts new signage initiatives in addition to the AEC market.

- Retailers are additionally slowly beginning to diversify past print and conventional show graphics into textiles, labels, and different utility areas.

- In fact, the print enterprise is finally on the mercy of general financial situations, and the economic system is doing fairly good for the time being: GDP continues to be rising and we now have file low unemployment. The one glitch is that inflation continues to be persistent, nevertheless it’s down dramatically from final yr. There may be nonetheless no actual signal of a recession…but(?), though the debt ceiling showdown is worrying, as a default will blow the whole lot up. (Replace: The Home handed the debt ceiling deal final night time in order that’s one much less factor to fret about.)

- And naturally sustainability continues to be a priority—not simply supplies however general enterprise practices, particularly end-of-life points: how do you sustainably discard/recycle previous signage and show graphics. I wish to reference the Vycom Recycling Program, which collects show graphics waste and disused signage and recycles into filler for Vycom’s decking materials.

So the show graphics and signage market is a wholesome one. Sure, it’s “grey,” however I can inform you firsthand that it’s potential to be grey and wholesome!

New Merchandise

Here’s a fast rundown of the key wide-format-related bulletins which have come out in to final six months or so.

Agfa launched its Jeti Tauro H3300 UHS with Varnish. It’s a hybrid unit that prints as much as 3.3m vast and as much as as much as 905 m2/hr.

Canon launched the Colorado M-series, “M” standing for “modular” because the machine is accessible in three configurations that permit customers to scale up (or down, because the case could also be) as their enterprise and their wants change. The brand new Colorado is 64-in. vast and options the brand new UVgel 460 CMYK inkset—and now presents a white choice. (You’ll be able to learn my write up of the brand new Colorado right here.)

At FESPA final week, Durst launched the P5 350 HS D4 hybrid printing system which notably options Durst P5 Robotics (keep in mind what I mentioned about “right here come the robots”?), a feeder/stacker unit comprising two Kuka robots to deal with unmanned manufacturing for a whole shift. The robots can choose up media from totally different pallets as much as 180 cm peak, feed them, and stack them individually. Printed media may also be turned 180° for reverse-side printing and fed right into a second printing system. Durst additionally launched the P5 350 HSR, a 3.5m LED roll-to-roll printer able to print speeds of as much as 670 sq. m. per hour. Durst additionally presents an entire suite of software program for all points of the printing course of together with Analytics, Workflow, Sensible Store (Net-to-print), and many others.

Final week at FESPA, EFI acquired a leap on what would be the subsequent nice leap for wide-format printing: single-pass printing. They previewed the Nozomi 14000 SD single-pass printer for signal and show graphics. It’s a 1.4m CMYK + white, orange, and violet gadget and is claimed to be 10 occasions quicker than present multi-pass printers. Search for this to hit the market later this yr. We’ll actually be preserving our eyes open for it.

Epson launched new items within the SureColor T-Sequence for AEC purposes: the 36-inch SureColor T5770DM and 44-inch SureColor T7770DM, and the 4-color SureColor F6470 and 6-color 44-in. SureColor F6470H dye-sublimation printers are actually transport. This isn’t wide-format per se, however struck me as fairly cool once I noticed it on the ISA Signal Expo: the SureLab D570 skilled minilab photograph printer for high-quality photograph printing in compact and light-weight design—in the event you nonetheless print footage, that’s. By the way in which, together with Roland, Epson has one of many broadest portfolios in all of vast format, providing solvent/eco-solvent, resin (aka latex), UV flatbed, dye-sublimation, and direct-to-film.

At FESPA final week, Fujifilm launched the Acuity Prime Hybrid, a 2m unit that prints manufacturing high quality beginning at 92 sq. m/hr. Additionally they launched the Uvijet HZ Thermoforming Ink for the Acuity Prime collection.

You may additionally recall that for years Fujifilm had partnered with Inca Digital, for whom they offered the Onset collection of high-end wide-format items. Inca Digital had additionally been engaged on single-pass expertise, however after Agfa acquired Inca, Fujifilm needed to search one other single-pass companion, and thus introduced that they had been working with Barberán to develop a single-pass printer for the show graphics and signage market. That’s anticipated to seem later this yr, and we’ll additionally undoubtedly be preserving a glance out for additional bulletins.

Late final yr at PRINTING United, HP launched the Latex 2700, a 126-in (3.2m) printer that may print as much as 1302 sq. ft./hr. (121 sq. m/hr.). It’s accessible in 4 twin roll and/or white ink configurations.

This yr, HP additionally launched SitePrint for the structure and development trade. SitePrint is a robotic printer like a Roomba that prints straight on the ground of a development web site to point the place partitions, doorways, and different architectural options go. It’s mentioned to have 10 occasions the productiveness of the guide course of. Accuracy is at present inside 3mm and they’re persevering with to enhance on that. HP had introduced SitePrint as an “early entry program” and might be asserting common availability later this yr.

Again at ISA in April, Konica Minolta had launched the most recent in its AccurioWide collection, the AccurioWide 250 hybrid, providing 2.5m width and speeds as much as 1,238 sq. ft./hr. It might probably additionally print 4 x 8-ft. boards in panorama, and customers can swap 4 x 8-ft. board manufacturing from lengthy to brief print tables and eradicate as much as 12 toes in printer depth and as much as 96 sq. toes of ground area.

Additionally at ISA, Mimaki had launched its first foray into direct-to-film (DTF) with the TFTxF150-75. (Direct-to-film is a switch printing expertise often, however not all the time, used for garment printing. A powder is printed on a plastic switch sheet which is then later utilized, utilizing a warmth press, to a garment or different floor.) The TFTxF150-75 has a most printing width of 80cm for DTF switch sheets. The PHT50 warmth switch pigment ink contains CMYK+W, and is claimed to supply as much as 22 T-shirts/hr. or 210 “brand” shirts an hour, the latter referring to small protection areas, corresponding to a small brand.

Mutoh launched the most recent in its XpertJet collection, the XpertJet 1682SR Professional eco-solvent printer that prints as much as 64-in. and comes with an 8-color choice.

Roland has had a busy yr, updating its True VIS line of UV printer/cutters—the LG Sequence UV printer/cutters, MG Sequence UV printer/cutters, and AP-640 Resin printer, the latter a problem to latex for printing wall décor, indoor indicators, retail shows, stickers and decals, banners and posters, car wraps, and different purposes on a variety of substrates. One main new product that launched at ISA is the model new VersaOBJECT CO line of hybrid UV flatbed printers. A alternative for the VersaUV LEC2 S-Sequence, the VersaOBJECT line is designed to print on all kinds of flat substrates in addition to 3D objects. It’s at present accessible in two widths (30- and 64-in.) in addition to three mattress lengths. The printer is belt-driven which permits for quicker loading/unloading, and the unit can print on rollfed media in addition to inflexible supplies and objects as much as 7.87-in. excessive. Complementary Rotary Rack equipment permit for printing on cylindrical objects like water bottles and YETI cups.

Roland additionally lately launched its personal DTF printer, the VersaSTUDIO BN-20D Direct-to-Movie System, permitting customers to create customized T-shirts, tote baggage, aprons, and different textile- and vinyl-based purposes with no weeding or masking required.

By the way in which, together with Epson, Roland has one of many broadest portfolios in all of vast format, providing solvent/eco-solvent, resin (aka latex), UV flatbed, dye-sublimation, and direct-to-film.

SAi, makers of Flexi, the design utility for the signal trade, introduced EnRoute 23, upgraded CAD/CAM design software program with a ton of latest options for CNC routing and related processes. SAi additionally expanded its Adendo.com platform. Flexi customers can entry on-line and in-person training, coaching, and assist. On-line “ecourses” present prolonged, pre-recorded, and self-paced coaching modules—some being at present provided embody “Designing Car Wraps in Flexi,” “Be taught Flexi in 3-Hours,” and “Full Flexi Coaching with Mark Rugen.” New programs might be added over time. Adendo’s “Digital Coaching” permits signal corporations to e book dwell on-line coaching classes that may final from half-hour as much as a number of hours to handle particular wants. There may be additionally an on-site choice, the place Adendo consultants will come out to a store and conduct in-person coaching or drawback fixing. For more information, go to https://adendo.thinkific.com/collections.

Final week at FESPA, Vanguard Europe launched its VK3220T-HS Subsequent-Era UV Flatbed, a 3.2m vast machine that may print as much as 360 sq. m/hr. Search for it to move throughout the pond earlier than too lengthy. (Am I the one one envisioning a flatbed printer doubling as a rowboat? Yeah, I believed so.)

And Zünd launched the BHS180 board dealing with system that contains board feeder, cutter, and off-load unit for top ranges of automation. (Zünd slicing tables have had robotic arm choices for a few years.)